FXOpen

There are some basic things that are often underestimated in Forex trading, but they should actually be considered. I think it’s hard to be a professional if you are going the wrong way when understanding the basics of Forex.

Most traders, especially beginners, do not study the basic knowledge of Forex. They are busy looking for a variety of indicators and systems which are perfect to be able to bring profit continuously, whereas perfect Indicators and perfect systems do not exist.

Psychology: control or change?

Psychology is the most instrumental factor in trading activity. Many traders argue that the psychology of trading is a thing that is most difficult to control. Even those traders, who have spent years to be able to control the psychological factor, support this idea. I often read in forums that psychological control is important. I agree with this opinion, but I’m sure it was not easy. In fact I think the psychological control in Forex trading is a very difficult thing. That’s why a lot of traders become losers simply because they were unable to control psychological factor properly.

I’ve been trying to learn how to control the psychological factor for years, but I’ve never achieved it. Everything becomes easier when I have a stable psychological condition. If you are afraid of losses in trading it means you have a bad psychological condition. If otherwise, you will never be afraid to face adverse conditions in trading. Basically you just need time to become a winner.

If you have a good system, I mean “win > loss ratio”, then you should have nothing to worry about when getting in a loss, because it is clear that you will anyway become the winner. So, what should you fear? I am sure it will be hard to control your fear when you are under stress. All you have to do is to change your psychological state and stop focusing on controlling your emotions. By analogy it would be difficult to control your wild animals unless they turn into tame animals, right?

The conclusion is that you must change your psychological condition for good. It will be hard to control trading, if you have a bad psychological condition. I’ve changed my approach in trading activity significantly, so I get better results – much better than before.

What is that made me able to change the psychological condition? The answer is a mindset. The market may be formed both on logic and on such emotions as fear, greed, and so on. If you use only logic in your trading activities, you might get bored, but if you are trading without negative emotions in Forex then it will not be stressful. But I’m not going to speculate on this, as I am far from understanding all the nuances here. I’m just trying to explain simple logic that I got during my Forex trading experience. So, the right mindset forms a good psychological condition.

Mindset can influence the psychological conditions

You need time and determination to be able to change your mindset. You should never underestimate the influence of mindset on Forex trading. Your trading powers actually exist in your mindset. That is why, one system, used by 2 different people will give different results, why? The answer is you they have a different mindset.

Between 2 traders, asked about the price movement over a certain time period, I would choose the one who admits that he does not know the result.

Professional traders can predict the market, but they do not pretend that their predictions are always accurate. They know they can be wrong in predicting the market.

Well, have you ever experienced finding the perfect indicator (100% accurate)? New traders usually spend lot of time looking for the perfect technical system. However, so far we have never found a perfect indicator. I’m not just talking about the custom indicators, but also such patterns as charts, candlesticks, and pinbars. When you see an indicator for the first time, you may be interested in using it. But when you use it, you may eventually replace it.

Success in Forex is all about mindset. Most traders start their trading with the wrong mindset thinking that they’d better follow the technical system given by a master. And you discipline yourselves to implement the rules of this system.

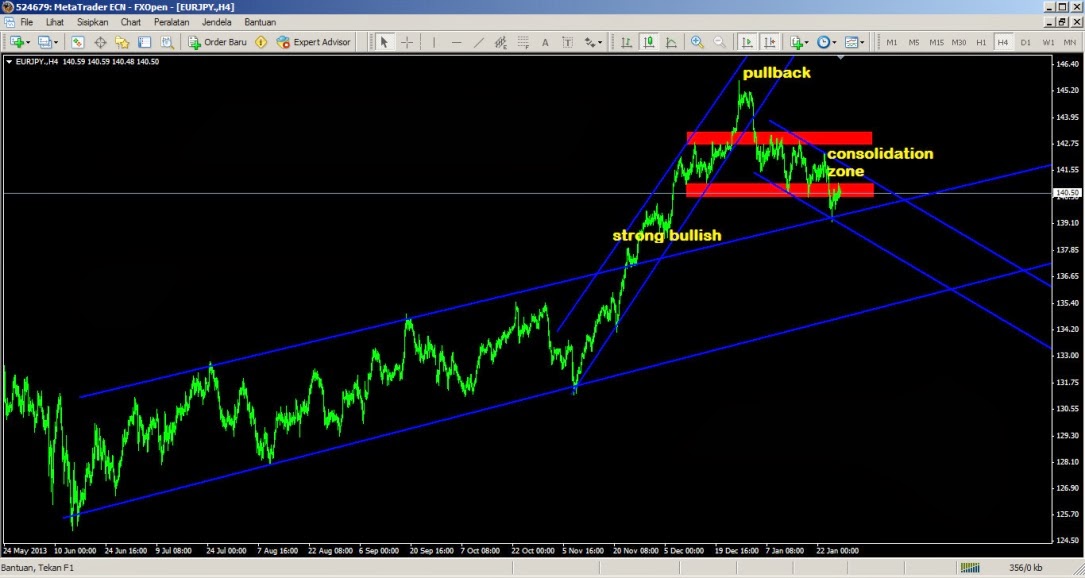

Look at the picture

Maybe you can get good results when using this template. But I’m sure you’ll try to focus on understanding the characteristics of these indicators. But you do not understand the characteristics of the market itself. And the big problem is your psychology as you are limited by the rules of the system. Without being given the opportunity to explore the market itself.

You may feel dependent on your template. So, you do not understand the essence of the market itself. And you will become lost and confused with no templates.

See the chart

If you are trying to understand the logic of the Forex market, you might be able to work even without an indicator and a template. This example of trading is based on the understanding of the market. Probably every trader has different ways of understanding the market depending on the mindset.

Sometimes beginners collect many indicators and templates. In fact, they learn a lot of technical indicators and systems, but sometimes they do not focus on understanding one of their strategies, perhaps the appropriate sentence is “jack of all trades is the master of none”. And unfortunately they forget about the market itself.

The logic of leverage

Even an experienced trader may not know the logic and function of leverage. I’m not going to give the definition of leverage, but I just want to ask. When you get stopped out, do you feel the bankruptcy? I’ll take an example: you are using 1:100 leverage and you have a $1.000 deposit in your account. Do you feel bankrupt if you lose $1.000 (stop out)? I think not … because you should go bankrupt if you lose $100.000. Why do I say that?

You use 1:100 leverage and your margin is $1.000. Then you use $100.000 capital for your trading. You have the potential of earning profits as you use $100.000. But you only have a potential loss of $1.000, right? Is this fair? So, you feel bankrupt if you have lost 100 times @ $1.000, right?

No stop loss = no risk management?

I’ve seen a lot of topics that discuss stop loss on various online forums. We often hear that the stop loss is important in the trade, and I do not argue this fact. But I often hear that “no stop loss = no risk management”. Do you agree with that?

So, what if I made a plan in trading, I had $1.000, the maximum risk = 10%. And I do not use a stop loss (my stop loss = my margin call = my stop out). But I made deposits 10x @ $100. I mean I was depositing as much as 10 times @ $100. So, what if I made a plan in trading, I had $1.000, the maximum risk = 10%. And I do not use a stop loss (my stop loss = my margin call = my stop out). But I made deposit 10x @ $100. I mean I was depositing as much as 10 times @ $100. So, my first deposit was $100 and I saved the rest in bank account. I lost my first deposit ($100), then I made a second deposit ($100). And so on. Is this the same way as you deposit $1.000, and use stop loss 10% of your equity? So, I do not agree that “no stop loss = no risk management.”

Hedging, Stop Loss, Cut Loss – which one is best?

Which is the most effective way to limit losses in Forex trading?

Stop Loss = we place an order to close a position when the price touches a certain price level.

Hedging or locking = we open a new position of different directions, but we did not close the first position. In practice, we can use the instant execution of pending orders or to hedge a position.

Cut Loss = manually close loss position.

Stop loss is just a tool in the trading platform. Its usefulness for making orders / closing loss positions is in accordance with our risk management.

Talking about hedging / locking, many traders are wrong in understanding hedging in online Forex trading. In my opinion, they do not understand that hedging is not a strategy. Hedging in one currency pair is the same thing with a stop loss and cut losses. There is no effect at all – just different in implementation.

Usually traders choose to use a stop loss, because they think they will get in trouble when looking for the right moment to open the locking if they use hedging. Right? I have read a lot about this case.

Well, hedging has the same effect as a stop loss. See the picture.

We use two different techniques, hedging and stop loss, in the similar market conditions.

Example:

We assume no spread in this example

– open buy in A. ( lot size = 0.1)

And then the price is down to B

– open sell in B ( lot size = 0.1)

loss= -5 pips (locking)

And then the price is down to B

– close sell position in C ( unlock)

The logic: TP sell (+5 pips). The rest position = buy (-10 pips)

And then the price goes up to A

– close buy position in A

The logic is TP buy (0 pips), the result = TP sell + TP buy = 5+0= 5 pips (profit)

Example:

We assume no spread in this example.

– open buy in A. ( lot size = 0.1).

And then the price down to B.

– close buy position in B

loss= -5 pips. (stop loss). There are no remaining positions.

And then the price down to B.

– open buy position in B

And then the price goes up to A.

– close buy position in A.

The logic. TP buy (10 pips), The result = SL buy + TP buy = (-5)+10= 5 pips (profit)

From two examples above, we see a similar condition of the market, but we use a different technique. We see a similar result = 5 pips profit. Do you understand the logic?

So, why are you afraid of using hedging? The logic of hedging is the same as the logic of a stop loss. But you are just using a different method. But it gives the same effect.

The logic: 1. Long positions (0.1 lot size) in A

2. There is no position in B (stop loss). Loss = – 5 pips (cleared)

Position is locked with the same lot size (locking / hedging): loss = -5 pips (locked). If you close all positions, then the result is loss = -5pips (cleared)

3. Long positions (0.1 lot size) in C

– open buy (stop loss method)

– close sell (hedging method)

Understanding point 2, we find a similar condition if all the positions are clear, we get the same effect by using a stop loss or hedging, but you will feel calm psychologically if you use hedging, why? The answer is you do not lose the balance in your account. But in fact you have lost. Yup, you’ve lost equity. So, we have to understand this case. Just focus on equity, not the account balance.

Open and closed positions in the trading platform (logic)

Forex trading is the exchange of money and we have to understand the essence of Forex trading. Do you understand the logic of the open position and the closed position? I feel more comfortable in trading as I understand the logic of it.

Maybe you already know about the Forex pairs, so I do not need to explain about it.

For example, you choose eur/usd for your trade,

* Open Position in eur/usd

Open Buy = usd is exchanged for euro

usd —————–> euro

Open Sell = euro is exchanged for usd

euro ——————> usd

* Close position in eur/usd

Close Buy = euro is exchanged for usd

euro ——————> usd

Close Sell = usd is exchanged for euro

usd ——————-> euro

We should not be confused with the system provided by the trading platform; we have to understand the logic.

Analogy:

1. We open a buy position at 1.3800 on eur/usd.

It means we exchange usd to euro (rate: 1.3800 usd/1 euro)

2. And then the price goes up to 1.4000. Then we take profit (closing buy position).

It means we exchange euro to usd ( rate: 1.4000 usd/1 euro)

Now I change the condition of point 2, I will not take profit at 1.4000 price, but I would hedge/lock at 1.4000.

Hedging/locking at 1.4000 = sell at 1.4000 using the same lot size.

It means we exchange euro to usd (rate 1.4000 usd/1 euro)

Look, do you find the same logic between the close position and hedging/locking? From the above conditions, we conclude close position is the same logic with hedging/locking.

So, we can conclude that hedging/locking = close position (take profit/stop loss). So, you do not confuse the use of hedging in the risk management methods, because it is basically the same as the stop loss/cut loss.

Description: Suppose we use two different methods for risk management (see the picture), and we perform transactions in eur/usd.

- Stop loss method:

Open buy position in A (usd —-> euro) / exchange usd to euro

Stop loss/close buy in B (euro —-> usd)/ exchange euro to usd

There is no position from B to C / clear.

Open buy position in C (usd —-> euro)/ exchange usd to euro

Take profit/close buy in D (euro —-> usd)/ exchange euro to usd

- Hedging method:

Open buy position in A (usd —-> euro) / exchange usd to euro

Open sell position in B (euro —-> usd)/ exchange euro to usd

We must understand that we exchange usd to euro, and then we exchange euro to usd. This means that there is no position from B to C / clear.

But technically, we still have long positions and short position with the same lot size / locking on the platform. We should not be confused about this, it is a system of platforms, logically, you do not have any position.

Take profit/close sell in A (usd —-> euro)/ exchange usd to euro

In this condition, you have a buy position, unlock hedging.

Take profit/ close buy in D (euro —-> usd)/ exchange euro to usd

Please, understand carefully, logically there is no difference between hedging and close position. So, do not be confused in using hedging methods, especially fears about hedging unlock. Just open a new position as in case with a stop loss. Hope you understand this.

The logic of the pair

Perhaps this is a trivial thing, but sometimes a lot of traders who do not understand the logic of a pair because they are too busy looking for technical systems. So, they forget an important thing, which is the essence of Forex trading and the basic knowledge they should understand from the very beginning.

Look at the chart (eur/usd)

And then I invert this picture, like a mirror.

What do you see? Yeah, a market that is inverted with eur/usd pair. We can call it usd/eur.

If you buy in eur/usd, it means you sell in usd/eur.

From the table above, you can conclude that the current prices are: 1 euro = 1.36984 usd,

and 1 usd = 0.73001 euro (inverse).

If you open a buy and sell at once in eur/usd, same as you open a buy in eur/usd and open a buy in usd/eur, or open sell in eur/usd and open sell in usd/eur.

Buy in eur/usd = sell in usd/eur = exchange usd to euro

Sell in eur/usd = sell in usd/eur = exchange euro to usd

So, if you buy and sell at once in eur/usd, (hedging) with one broker, then you do not have any transactions. Right?

But if you do it with 2 different brokers (buy with a broker A and sell with a broker B), then you have a transaction with each broker.

Analogy: imagine if you trade with me, you buy 1 dollar from me and sell 1 dollar to me. I mean… you exchange 1 dollar to euro, and exchange euro to 1 dollar. What do you do? You do not do anything. Yes, you buy 1 dollar and sell 1 dollar at the same time.

Conclusion: hedging in one pair (with one broker) is a useless thing. It is only a platform system, locking/hedging = close position. You do not have a clear purpose why you are hedged in a pair (with one broker), different conditions with hedging done by the exporter.

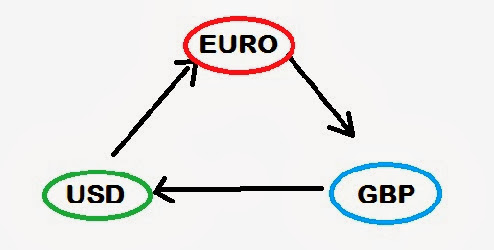

Do you ever use a hedging strategy for 3 pairs? Maybe, these are different conditions, I’ve never tried it. But this may be developed by you. We took three mutually correlated pairs.

Example: eur/usd, gbp/usd, and eur/gbp

How to hedge in these 3 pairs?

If I open a buy position in eur/usd,

usd =====> euro

So, I open short positions in eur/gbp

eur =====> gbp

And then I open a sell position in gbp/usd

gbp =====> usd

So, if you create an image for this position, it will form a circular transaction, such as a locked chain.

Now here is the question: a broker provides only a few pairs: eur/usd, usd/jpy, chf/jpy and aud/chf. You have euro, and you will exchange it to aud. Here you may not redeem directly, because you do not find eur/aud on the platform. Maybe, you’ll make some deals.

1. sell in eur/usd (eur—> usd)

2. sell in usd/jpy (usd —> jpy)

3. buy in chf/jpy (jpy —> chf)

4. buy in aud/chf (chf —>aud)

Zero (0) is the lowest value of the currency

All countries try to maintain their economic stability so that we can be sure that every state has always maintained the stability of the value of their own currency.

If you invest in currencies, then will you go bankrupt if the value of a currency falls to zero (0)? Maybe, we would think that the currency has become garbage if it falls to zero (0) = no value.

Have you ever wondered if euro, usd, jpy, and other strong currencies can be garbage (no value)? Perhaps, nowadays we think that it is impossible. But we do not know what world situation will be in the future. So, anything can happen in the world.

We take the example eur/usd, I change the vertical scale of the chart (monthly).

If you buy euro at $ 1.4000 / euro, the biggest loss for you is if the euro became $ 0000 (not valuable / garbage). That means that your maximum loss is $ 1.4000 / euro. Usually 1 lot size = 100.000 (depending on the rules of the broker and the type of account). If you buy the euro at $ 1.4000 by using 1 lot size, then you have a contract of 100.000 euros.

That means that your maximum loss is $ 1.4000 / euros. Usually 1 lot size = 100000 (depending on the rules of the broker and the type of account). If you buy euros at $ 1.4000 by using 1 lot size, then you have a contract 100.000 euros. If you use 1:1 of leverage then you are supposed to go bankrupt if euros fell to $ 0.0000 (without the stop out level). Then, you use capital = 100,000 x $ 1.4000 = $ 140.000. If you use 1:100 of leverage, your capital is $ 140.000: 100 = $ 1.400. It is a simple analogy.

Imagine if euros fell to $ 0.0500. What will you do if you have $100 of capital? Are you going to buy euros using all your capital? Or are you going to use all your capital if the price of euros goes back to $1.4000?

Of course, as an investor, you should minimize the risk and maximize profits. If you buy at a price of $ 0.0500 / euros, the maximum risk is $ 0.0500/euro. But you can buy more euros just by using $ 100 of capital.

A winning percentage, and risk – reward ratio

I often hear that the winning percentage below 50% is more of a loss (not profitable). Is it true? I always argue about that statement. I think winning percentage below 50% is also profitable. It all depends on the risk – reward ratio.

For example: you have to adjust your money management to the system. Then you set 1:4 risk – reward ratio (1 risk – reward 4).

Suppose, you have set the maximum risk for each position in the trade, you have set a stop loss: 20 pips (in accordance with the maximum risk). Then take profit: 20 x4 = 80 pips.

What is the winning percentage you need to be profitable in accordance with the risk reward ratio you’ve set?

Many people say that the win <50% is not profitable.

Suppose, we have 100 trades, 50% = 50% win loss = 50 positions.

Total profit: 50 x 80 (take profit) = 4000 pips.

Total loss: 50 x 20 (stop loss) = 1000 pips.

Accumulation = Total profit – total loss = 4000 – 1000 = <3000 pips (profit) === profitable…

Conclusion

Maybe, I still have a long journey ahead, but this simple logic has changed my mindset. Everything I’ve put down here is based purely on my own understanding and the result of my observations. Many traders say that making profit consistently in Forex is difficult. Yes, it’s true. But if we have a good mindset about Forex trading, we will find it easy to make profits consistently. Forex trading is essentially simple and not as complex as I expected when I was looking for a profitable system. But we do not realize it, because we take it too complex and complicated. But it is a natural process toward maturity in the Forex trading.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.